Transforming a good business idea into reality often calls for more than just passion, and planning asks for capital. Whether a startup or an existing venture is being launched or expanded, it is about the crowning glory of the investors who unlock your business potential.

Yet, getting investors is not just an issue of having the best idea; it needs preparation, strategizing, and framing of the idea: networking with angels and venture capitalists, organizing an eye-catching pitch, and sharing it with the internet funding world.

Bringing a business proposal to life usually depends on one fundamental aspect: funds. You might have the most visionary idea on the face of the earth, but without the money, it could never be brought to life. That is where the role of the investor steps in.

Getting the correct investor is not only a funding transaction, rather, it is a relationship. It is about creating an alignment of vision, values, and expectations. Yes, even as a new business, it is possible. Let’s take it step by step.

This guide will take you through step-by-step drilling and insights into finding investors willing to underwrite your vision and support you in your growth.

Begin with a Clear and Compelling Pitch

Before you go looking for investors, make sure you can clearly explain your idea in simple terms. What problem are you solving? Who are your customers? Why now? How will you make money?

Consider that your pitch is a movie trailer: it needs to be exciting, create a picture of the opportunity, and get the investor on the verge of demanding more. Dropbox’s original pitch is a good example. The founders did not simply say, “We keep files in the cloud.”

They illustrated how much of a headache it is to lose USB keys or send files to yourself via email and how easy their solution is to get your files from any location. If your solution addresses an actual pain point or hits on a fresh trend, put that front and center.

Identify What Type of Investor You Require

Not everybody who invests is alike. Some invest at the beginning and shape your concept. Others invest when you already have momentum and revenue.

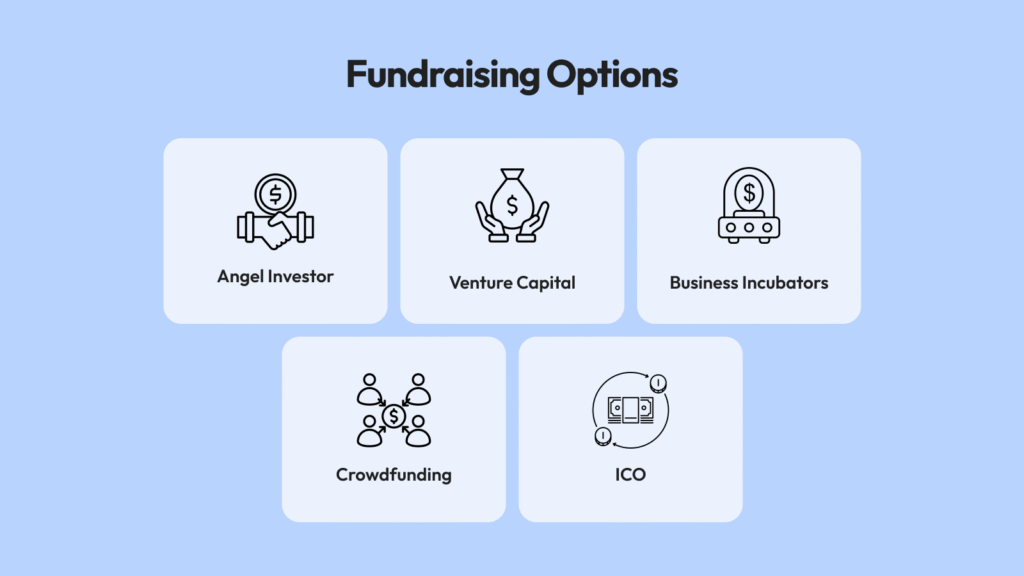

Here is a summary:

- Friends and Family: Very often the initial choice. They know who you are, so they are staking more on you rather than the concept. Be professional nonetheless: make agreements to keep things from creating future tension.

- Angel Investors: High-net-worth individuals who invest in early-stage companies. They write checks ranging from $10,000 to $250,000 and usually come with mentorship in addition to money.

- Venture Capitalists (VCs): They handle large funds and generally put capital into companies that already have growth and a team in place. They might invest millions, but they look for aggressive growth.

- Incubators and Accelerators: Y Combinator or Techstars provide funding, mentoring, and network connections for a share of equity. Ideal for novice founders.

- Crowdfunding Platforms: Consider Kickstarter or Indiegogo if you need to crowdfund a physical product. For equity, Republic or SeedInvest allows you to crowdfund from the general public.

If you are creating a scalable technology product, a VC or an accelerator is a better choice. But if opening a local bakery is on the agenda, a local angel or a crowdfund may be a better fit.

Also Read: How to Start a Business in IT

Develop a Prototype or an MVP

You do not necessarily require a finished product to raise money, but something concrete is beneficial. Envision two founders pitching a smart home security solution. One presents a slide deck, and the other presents a functional demo. The demo always takes the win.

You can start creating an investment platform from a minimum viable product (MVP). Your MVP shouldn’t be perfect, but it should be enough to demonstrate that your solution is viable and that people want it. Not even a simple landing page with a sign-up form is necessary.

It indicates interest, validates the concept, and provides you with feedback to present to investors.

Leverage Your Network First

Your initial investor is usually someone who knows you or someone who is acquainted with someone who knows you. Begin by compiling a list of everyone with whom you had contacts: colleagues, classmates, mentors, family, and former supervisors. Contact them and tell them what you are creating.

Do they know someone who invests in early-stage concepts?

You’d be amazed at how many connections are sleeping in your inbox. For instance, a founder created a mobile fitness app and made a LinkedIn post. A former professor happened to see the post and introduced him to a retired technology exec who subsequently invested.

Don’t be shy. People love helping builders, especially when they see passion and clarity.

Join Startup Events and Pitch Competitions

In-person and virtual events are goldmines when it comes to connections. Founders, investors, media, and mentors all mingle in one place. Pitch competitions are especially helpful. Not only do they make you sharpen your message, but they frequently have investors in attendance.

Meetups such as Slush, TechCrunch Disrupt, and Web Summit draw leading VCs. Local meetups, demo days at the university, and Chamber of Commerce conferences can be equally worthwhile.

Let’s assume you’re creating a restaurant SaaS product. Visiting a food-tech summit would put you in contact with specialized investors who already know your space. Bring business cards, your pitch deck on your phone, and an honest interest in meeting individuals—not solely seeking money.

Build in Public

Today, posting your experience online can not only beckon users but also investors. Founders at X, LinkedIn, and even Reddit take note: Document everything, from idea conception through product launch. This creates an audience, generates buzz, and occasionally catches an investor’s eye.

One of the browsers’ video editor’s co-founders tweeted regularly: daily updates of revenue milestones, product features, and support problems.

Later, after several months, he raised $1.5M from investors who had been quietly observing him. Be consistent. Don’t need to go viral. Just stay authentic, open, and engaged.

Create an Investor-Ready Pitch Deck

If an investor is expressing interest, they’ll want to see your deck. Your pitch deck should address the following questions:

- There’s a problem?

- What’s your solution?

- Who is our target market?

- What size is the opportunity?

- What’s your business model?

- Who is part of your team?

- What’s your traction?

- How much are you raising, and how do you plan to use it?

Keep it brief: 10–12 slides is best. Use visuals over text. Display the product. Use graphics if you have traction. Make your numbers reasonable. If you are pre-revenue, highlight vision and validation. There are plenty of free templates available online, yet ensure that your narrative shines through. Investors put money into narratives, not stats.

Make Your Introduction Count

Preparation is the key when you secure a meeting. Research the investor in advance. Identify which industries they invest in, which stage they are investing at, and where they have invested historically.

Rehearse your pitch to the point where it’s second nature. Don’t memorize it word for word, though, make it natural-sounding. Prepare yourself to go into metrics, describe assumptions, or discuss competition.

And always ask questions. Investors want to see that you’re selective, not just money-hungry. After the meeting, send a thank-you email and your pitch deck. Be professional, friendly, and to the point.

Anticipate Rejection (and Learn from It)

Raising funds is tough. Even the largest names endured plenty of rejection. Dozens of investors rejected Airbnb’s co-founders Airbnb’s. Their plan to rent out air mattresses in someone else’s apartments seemed insane at the time. Yet they continued to hone their pitch and build demand.

Every “no” is an opportunity to make it better. Ask for feedback. Apply it. Continue building. Most are not saying “no” to you; they may have other priorities, timing, or simply have missed the vision. Persistence pays off.

Use Investor Platforms

If networking and events are not yielding results, try investor-matching platforms.

- AngelList: Suitable for finding early-stage backers, syndicates, and angel investors.

- Gust: Utilized by startups to join accelerator programs and network with investors.

- SeedInvest and Republic: For equity crowdfunding.

- PitchBook and Crunchbase: Used for pre-contact research about investors and firms.

These sites provide you with access to thousands of possible backers—but keep in mind, a cold pitch is still a cold pitch. Make your message tailored, keep it concise, and get to the point quickly.

Don’t Forget Strategic Investors

Not all funding is from traditional sources. Occasionally, prospective customers or partners can become investors. If you’re creating logistics software, the shipping company may consider funding you. If you’re developing an application for health, you may have a fitness brand investing in and co-marketing it.

These strategic investors not only make investments but also provide reach, industry expertise, and pre-existing trust. Meet them with an unmistakable value proposition: how your idea supports their business, the type of equity you are presenting, and the expected returns they can anticipate.

Continue Building, Either With or Without Funding

Oftentimes the best strategy for attracting an investor’s attention is to continue growing, even slowly, even messily. Bootstrapping instills toughness and compels innovation. When you demonstrate that you’re willing to get things done without capital, you make your narrative more robust.

Aniqa Maneesh, the founder of an online tutoring business, could not raise capital to fund her company. So, with no other option, she began tutoring herself, hired part-time tutors, and reached $5,000/month in sales. Once she had actual numbers, investors approached. Slides are no match for traction.

Closing Words

Finding investors is not easy, but it is not the exclusive domain of insiders or Silicon Valley moguls. It takes vision, perseverance, and evidence that your idea is important. Start small. Communicate clearly. Keep pushing forward. Your first “yes” may be nearer than you realize.